A few feet of land does not sound like much. However, a three-foot strip along a fence line can turn into one of the most expensive problems a homeowner faces. Across the country, recent viral property line disputes show the same pattern. Two neighbors disagree. Each feels certain. Then the costs start stacking up fast. Most people focus on the argument. Smart property owners focus on the numbers. When you break it down, the real story is not the fight — it is the boundary survey cost compared to the fallout cost.

How a Small Boundary Problem Turns Expensive Fast

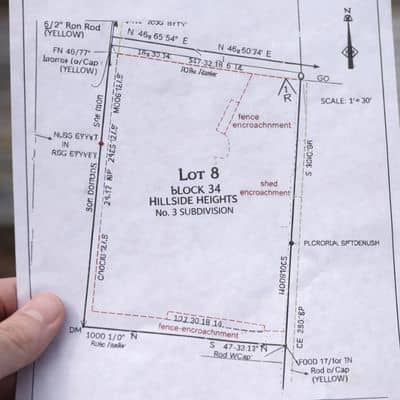

At first, the issue looks simple. A fence sits a little off. A driveway edge crosses a line. A shed corner lands in the wrong place. One neighbor raises a concern. The other disagrees. Nobody wants to move anything yet.

Then reality kicks in.

Contractors refuse to continue work without verified lines. Buyers hesitate. Lenders pause. Title reviewers ask questions. As a result, what started as a three-foot disagreement turns into a multi-step correction project.

Meanwhile, every step costs money.

This situation happens more often than homeowners expect, especially in fast-growing metro areas where lots sit close together and improvements happen quickly.

The Hidden Cost Ladder Most Homeowners Never Expect

Many people compare one number only: the boundary survey cost. However, that number rarely stands alone once a dispute starts. Instead, costs climb in layers.

Here is how the ladder usually builds:

First, you order a boundary survey. Next, a contractor must pause or return later. After that, crews may need to restake lines and re-measure improvements. Then design changes follow. Permit files may need updates. In some cases, a title company requests new documents. Finally, legal review enters the picture.

Each step adds another bill.

Individually, these charges may look manageable. Together, they often exceed the survey cost many times over. Therefore, early measurement almost always costs less than late correction.

Construction Rework Costs Hurt More Than First-Time Builds

Now let’s talk about construction. Fixing work always costs more than doing it right the first time. Contractors must remove materials, haul debris, and rebuild from scratch. That process takes extra labor and extra scheduling.

For example, crews may need to remove and reinstall a fence. A patio might need partial demolition. A retaining wall could require redesign. In tougher cases, concrete slabs need cutting and repouring. Even small shifts create ripple effects across the whole layout.

Moreover, contractors charge remobilization fees when they return to a paused site. Equipment delivery, crew setup, and scheduling all restart. Consequently, correction work rarely comes cheap.

When homeowners compare those bills to a boundary survey cost, the math becomes very clear.

Property Sales Suffer When Boundary Issues Appear Late

Boundary problems also damage real estate deals. Many owners do not discover line conflicts until they try to sell. During buyer review, a survey reveals an encroachment or setback issue. Suddenly, the deal slows down.

Buyers often request credits. Some demand repairs. Others walk away completely.

In addition, lenders may delay approval until the boundary issue gets resolved. Title companies may require updated surveys or corrective documents. Because of that, closing dates shift and moving plans fall apart.

Sellers then face price cuts or repair demands under pressure. All of this starts from a line that someone should have verified earlier.

Again, boundary survey cost looks small next to a delayed or broken sale.

Lenders and Title Teams Treat Boundary Problems Seriously

Many homeowners feel surprised when lenders care about property lines. However, lenders protect their collateral. They want clear ownership and clean records.

If a survey shows an improvement crossing a line, lenders raise questions. If a structure violates setbacks, underwriters pause. If monuments conflict with records, title reviewers request clarification.

Each request adds time and sometimes extra professional fees. Furthermore, rate locks may expire while files sit in review. That delay alone can raise loan costs.

Therefore, accurate boundaries support smoother financing and cleaner title work.

Time Delays Also Carry Real Dollar Costs

People often ignore time costs. Yet delays drain budgets quickly. When projects stop, money keeps moving.

Construction loans continue charging interest. Crews move to other jobs. Material prices may rise before restart. Permit windows may close and require refiling. Storage and staging costs may appear.

In other words, time equals money on any property project.

A verified boundary reduces delay risk. Clear lines allow steady progress. That stability protects both schedule and budget.

Why Boundary Survey Cost Usually Delivers the Best Return

When you compare categories instead of just prices, the value becomes obvious.

A boundary survey cost covers measurement, research, monument recovery, and certified documentation. That work creates legal clarity. It supports permits, construction, financing, and resale.

By contrast, dispute costs include rework, delay, negotiation, and legal review. Those expenses produce no added property value. They only fix preventable mistakes.

Therefore, a survey acts like risk control. It prevents waste instead of repairing damage.

Smart owners invest early. Reactive owners pay later.

Where Early Measurement Pays Off the Most

Some situations produce especially strong returns on early surveying.

Pre-construction planning benefits immediately from verified lines. Pre-listing preparation avoids buyer surprises. Major yard improvements need accurate placement. Lot adjustments demand precise limits. Refinancing with new structures also requires clean boundary data.

In each case, early clarity prevents later conflict.

Homeowners who plan ahead rarely regret the survey cost. Homeowners who guess often regret the correction cost.

The Cheapest Three Feet You Will Ever Measure

A three-foot property line fight feels emotional on the surface. However, the real impact shows up in dollars, delays, and disrupted plans. Small boundary mistakes create big financial waves.

Meanwhile, boundary survey cost stays predictable and controlled when ordered early.

Clear lines protect projects. Clear lines protect sales. Clear lines protect neighbor relationships too.

So if any boundary question exists — even a small one — measure first. Fixing mistakes costs far more than preventing them.